Loan Shark AI

Loan Shark AI

Loan Shark AI is an innovative AI-powered SaaS platform designed to empower borrowers by providing comprehensive analysis of loan documents. Its primary purpose is to protect individuals from predatory lending practices, hidden fees, and unfavorable terms that are often buried deep within complex legal contracts. This service is ideal for anyone considering a new loan, refinancing an existing one, or simply wanting to understand their financial commitments better.

Key Features

- Fine Print Probe: Utilizes advanced AI to uncover hidden fees, escalation clauses, and risky terms that lenders hope you miss.

- Credit Score Impact: Analyzes how your credit score influences loan rates and identifies opportunities for savings with an improved score.

- Refinance Advisor: Offers smart refinancing analysis, complete with trusted lender recommendations and detailed projections of potential savings.

- Document Analysis: Supports secure upload of various loan contract formats (PDF, DOCX, scanned images) for instant AI-powered insights.

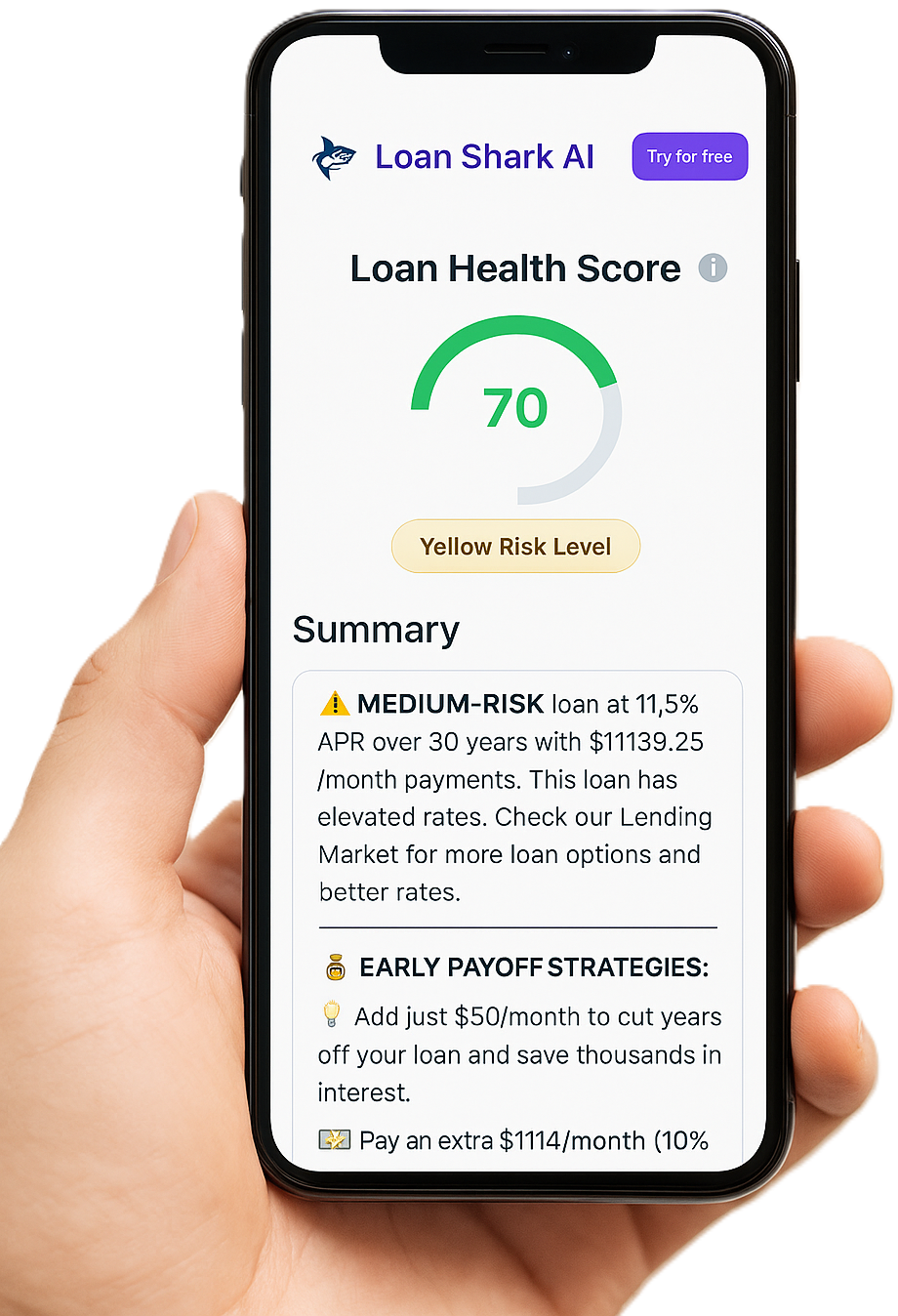

- Health Score & Risk Assessment: Provides a clear health score and risk assessment of your loan, along with a payment stress test.

- Advanced Loan Metrics: Delivers in-depth metrics and access to lending market insights for informed decision-making.

Use Cases

Loan Shark AI is invaluable for individuals about to sign a new loan, whether it's for a mortgage, car, or personal loan. By uploading their loan contract, users can quickly identify any predatory clauses or hidden costs before committing, potentially saving thousands of dollars and avoiding long-term financial distress. It acts as a crucial second pair of eyes, ensuring transparency in a typically opaque process.

Furthermore, the platform is highly beneficial for those looking to refinance. The Refinance Advisor feature helps users understand if refinancing is a viable option, providing personalized savings projections and connecting them with reputable lenders. This empowers borrowers to optimize their existing loans and improve their financial health.

Pricing Information

Loan Shark AI offers a flexible pricing model, starting with a Forever Free plan that includes basic document analysis, health score, risk assessment, and payment stress test. For more in-depth analysis, the One-Time Use option is available at $9.99 per analysis, covering advanced features like Fine Print Probe and Credit Score Impact. The Pro plan, priced at $19.99 per month (with 15% savings on annual billing), provides unlimited uploads, scenario simulations, and priority support. An Enterprise plan with custom pricing is also available for larger organizations requiring portfolio analysis and API access.

User Experience and Support

The platform is designed for ease of use, turning complex loan documents into clear, actionable insights. Pro users benefit from advanced interactive charts and priority processing. Support resources include a Help Center, Glossary, and direct contact options, ensuring users can get assistance when needed. The interface aims to demystify loan terms, making financial decisions more accessible.

Technical Details

Loan Shark AI prioritizes user privacy and data security. It employs professional-grade technology with end-to-end encryption for all data in transit and at rest. Crucially, documents are processed securely in memory only and are deleted immediately, ensuring no permanent storage of sensitive financial contracts. This commitment to security adheres to enterprise security standards and compliance.

Pros and Cons

- Pros:

- Protects borrowers from predatory lending and hidden fees.

- Provides clear, actionable insights from complex legal documents.

- Offers secure and private document processing with no permanent storage.

- Includes a free tier and flexible paid plans for various needs.

- Features a dedicated refinance advisor and credit score impact analysis.

- Cons:

- Explicitly states "This is not legal or financial advice," limiting its scope.

- The "One-Time Use" plan requires payment for each individual analysis.

- Specific programming languages or frameworks are not disclosed.

Conclusion

Loan Shark AI stands as a vital tool for anyone navigating the complexities of loan agreements. By leveraging AI, it empowers users to make informed financial decisions, avoid costly mistakes, and secure better loan terms. We encourage you to explore Loan Shark AI today and take control of your financial future.

Comments

Achievement

Publisher

Paul Murphy

Launch Date2025-09-04

Platformweb

Pricingfreemium

Tech Stack

#web