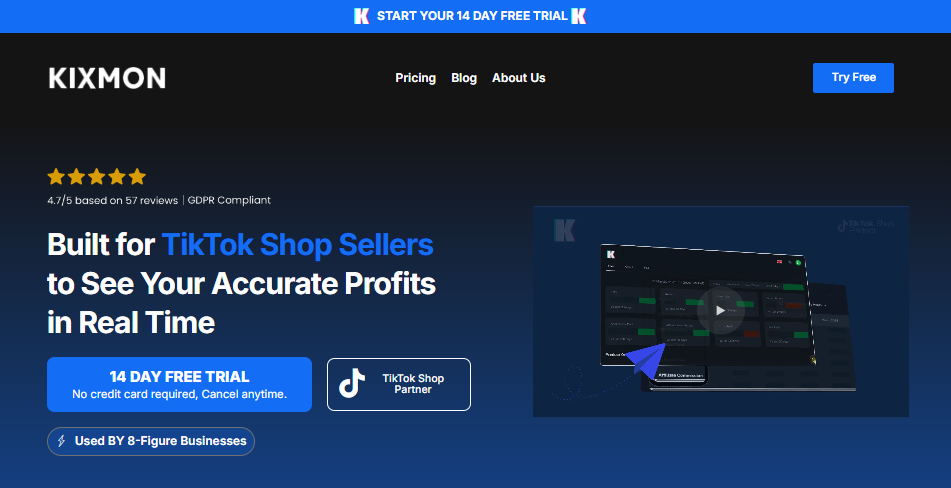

Kixmon is a specialized SaaS platform designed to provide TikTok Shop sellers with accurate, real-time profit tracking and advanced analytics. It eliminates the guesswork and manual effort associated with managing finances on TikTok Shop, helping businesses understand their true net profit by uncovering hidden fees and consolidating all financial data.

This tool is ideal for individual sellers, small teams, and growing enterprises operating on TikTok Shop, including dropshipping businesses, who need precise financial insights to optimize their operations and scale effectively.

Key Features

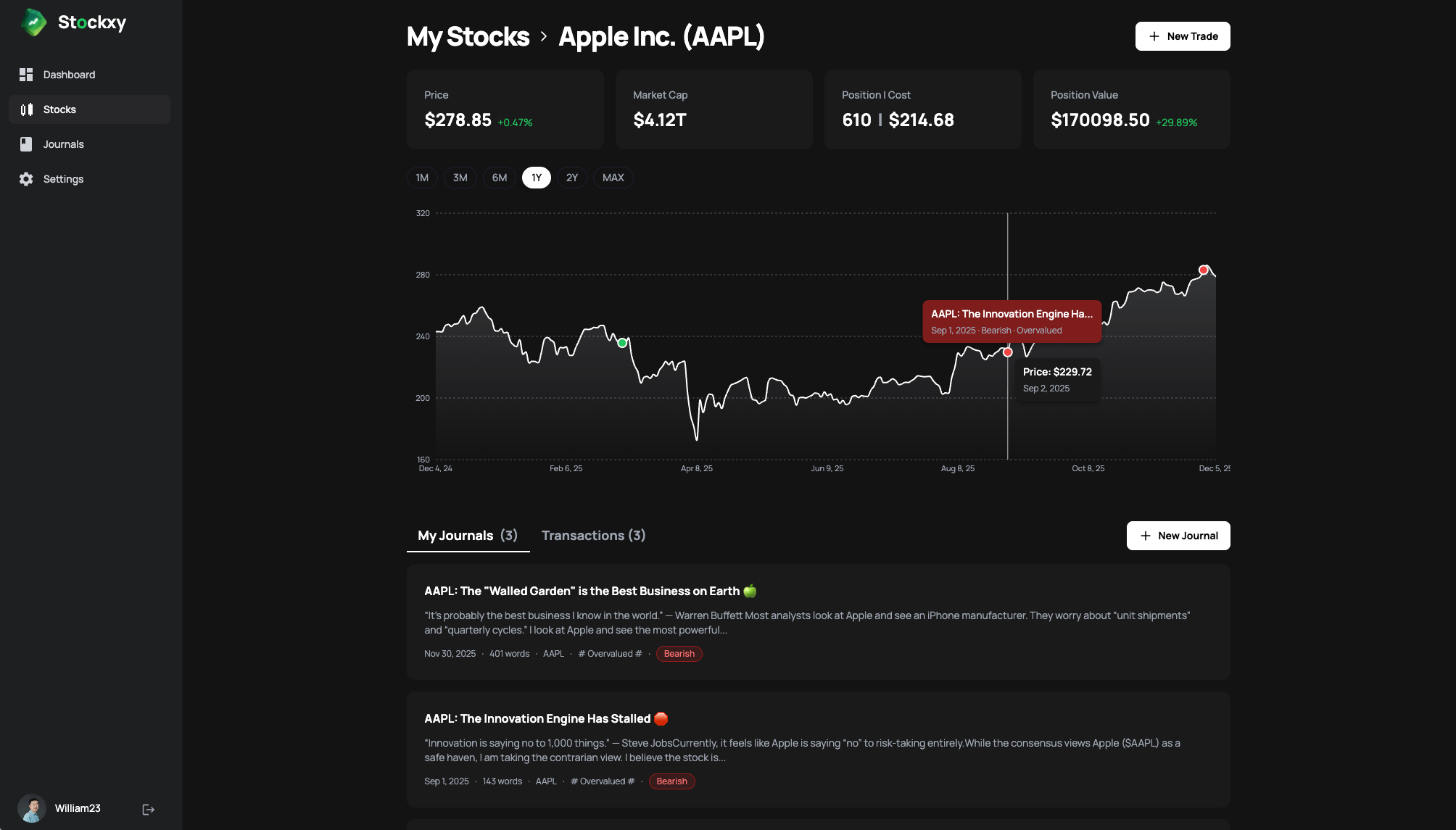

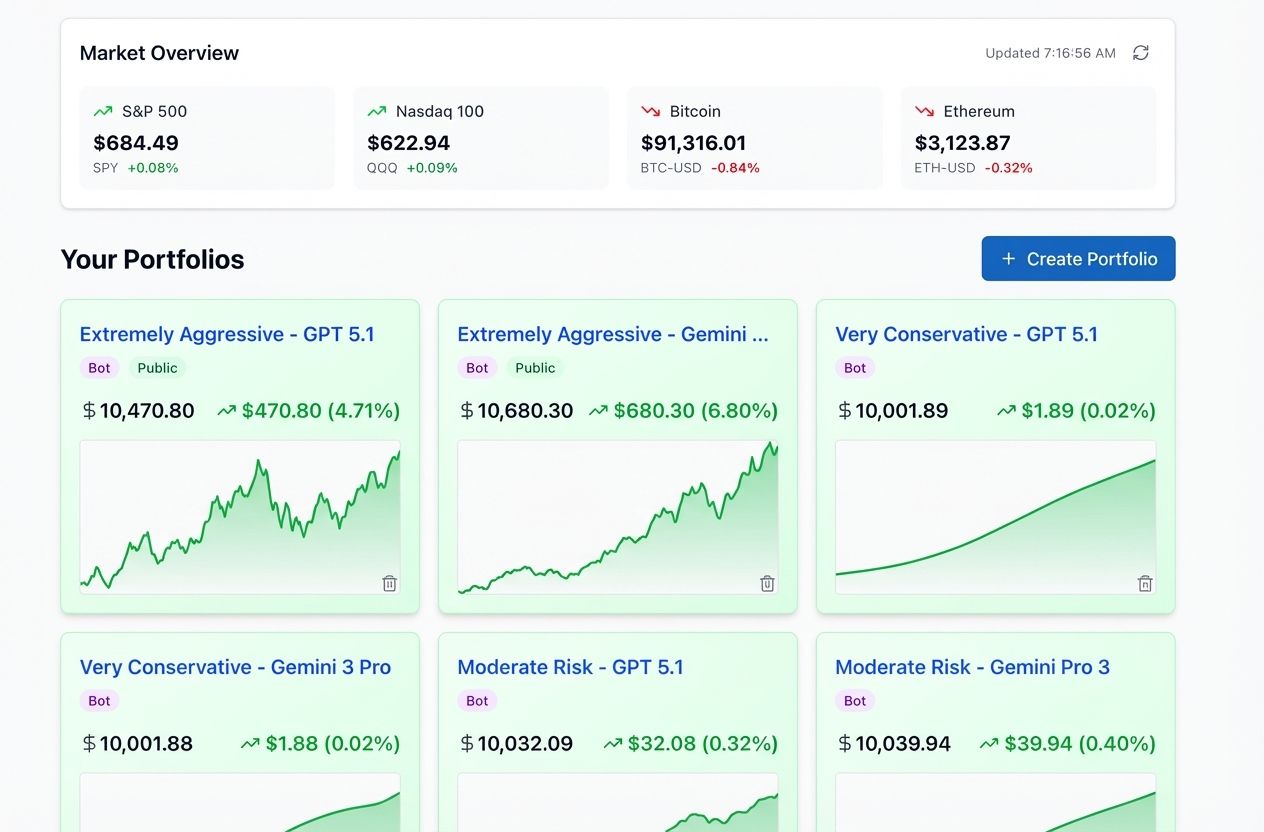

Real-time Profit Dashboard: Consolidates sales, refunds, ad spend, commissions, and net profit into one clean, visual interface for instant clarity.

Comprehensive Fee Tracking: Automatically accounts for all TikTok Shop fees, including platform fees, shipping charges (FBT, TikTok Shipping, Seller Shipping), returns, discounts, affiliate commissions, GMV Max Ads, and more.

COGS Management by Period: Allows for periodic COGS tracking, bulk uploads, and per-variation updates to reflect changing expenses accurately.

Product-wise Profitability: Provides detailed profit analytics for each product, factoring in COGS, shipping, fees, ads, and affiliate cuts to identify best-sellers and hidden money drains.

Indirect Expense Tracking: Easily manage and allocate recurring or one-time costs like agency retainers, creator fees, editing, UGC production, team salaries, and software expenses.

Ad Spend & Commission Monitoring: Offers a complete view of ad performance, including affiliate ad commissions, total ad spend, GMV Max ad spend, and TikTok ad credit usage.

Use Cases

Kixmon is invaluable for TikTok Shop sellers who are tired of juggling multiple spreadsheets and platforms (Seller Center, Ads Manager, Affiliate Center) to understand their profitability. It automates the complex process of calculating net profit, ensuring that every hidden fee and cost is accounted for, which is often missed by traditional BI systems.

For dropshipping businesses, Kixmon provides critical insights by tracking GMV, orders, advertising costs, and various shipping fees, allowing for accurate profit calculations even with estimated shipping costs that are later updated with actuals. This enables sellers to make data-driven decisions, identify profitable products, and optimize their ad spend to maximize returns.

Pricing Information

Kixmon offers flexible pricing plans: Start ($49/month or $490/year), Pro ($99/month or $999/year), and Elite ($199/month or $1999/year), catering to different order volumes and history retention needs. All plans include a 14-day free trial with no credit card required, allowing users to cancel anytime. Annual subscriptions offer a discount equivalent to two months free.

User Experience and Support

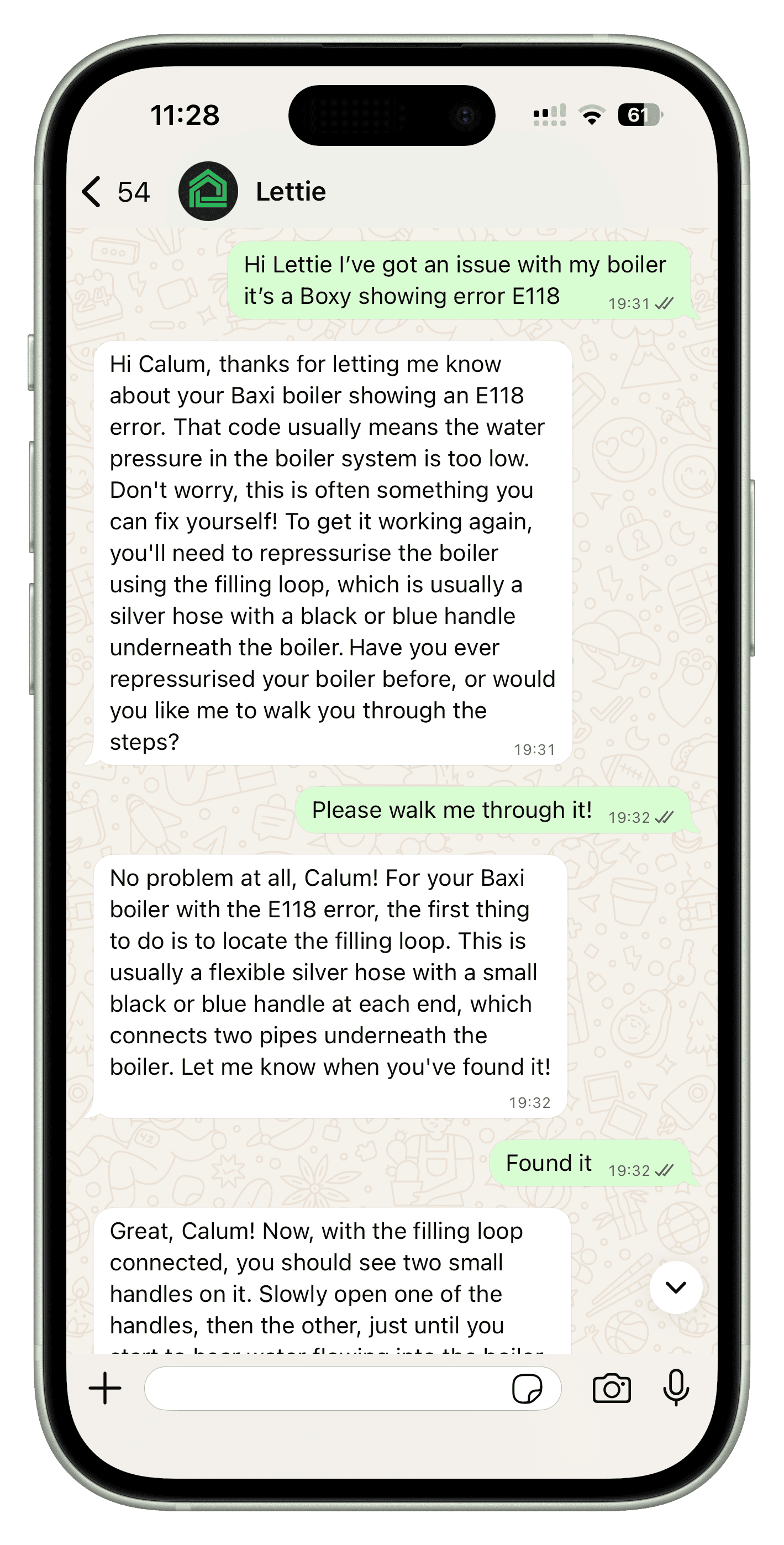

Kixmon boasts a user-friendly interface designed for quick and convenient data access. Setup is typically fast, taking around 15 minutes, though it may extend to 45 minutes for accounts with a large volume of historical orders. The platform integrates seamlessly with TikTok's APIs, ensuring real-time data updates. Comprehensive customer support is available via WhatsApp (+1 (555) 123-4567) and email (anna@kixmonapp.com), with an optional free 15-minute onboarding call to help users get started.

Technical Details

Kixmon integrates directly with TikTok's official APIs, including the Seller Center, Ads Manager, and Affiliate Center, to pull real-time data on sales, ad spend, fees, and commissions. This API-driven approach ensures accuracy and eliminates manual data entry. The platform prioritizes security, employing advanced encryption protocols and adhering to relevant security standards to protect user data.

Pros and Cons

Pros:

Highly accurate real-time net profit tracking, including hidden fees.

Consolidates all TikTok Shop financial data into one dashboard.

Detailed product-level profitability analysis.

Automates COGS and indirect expense management.

Excellent customer support and onboarding assistance.

14-day free trial with no credit card required.

Supports dropshipping businesses effectively.

Cons:

Currently supports only the United States market.

Initial data fetching can take up to 45 minutes for large order histories.

No specific technical stack details provided for advanced users.

Conclusion

Kixmon is an essential tool for any TikTok Shop seller looking to gain a clear, accurate, and real-time understanding of their business's profitability. By automating complex financial calculations and uncovering all costs, it empowers sellers to make informed decisions and scale their operations with confidence. Start your 14-day free trial today to unlock your true TikTok Shop net profit.